Backing Chainway Labs to Augment Bitcoin as a Compute Platform

Galaxy is proud to announce our lead investment in the seed round of Chainway Labs, which is developing Citrea, Bitcoin’s first ZK Rollup.

We made the investment with a strong view on the fundamental unit economics of rollups in mind (see here for our piece on The Best New Business Model in Crypto), understanding that rollups with differentiated value propositions have the chance to capture substantial network effects and the best rollups will end in “the fat tail of the power law distribution.” In our eyes, Citrea meets those criteria and more by unlocking Bitcoin’s distinct strengths.

Bitcoin’s Massive Monetary Base Has Been Stranded

Bitcoin offers a simple product: send/receive BTC and store it without intermediaries. It is powerful enough in its simplicity to have earned its status as a form of money which stands outside state control.

While Bitcoin is a truly decentralized and censorship-resistant form of money — a massive achievement and one which we believe will play a greater role in the future — there are limited on-chain financial applications that allow one to use BTC. That massive $1T capital base is stranded without access to trust-minimized financial services applications.

A Monetary Asset or a Compute Platform?

Moreover, there have always been disputes within the Bitcoin community about what the network really is: is Bitcoin (i) primarily a scarce digital asset (monetary phenomenon), (ii) primarily a distributed and uncensorable p2p networking technology (internet computer network), or (iii) primarily a decentralized compute network that firstly provides a financial application called money but also may do other things (decentralized consensus platform)? And beyond what Bitcoin is, what should it be? These questions have driven debates within Bitcoin for 15 years and the pendulum continues to swing.

Where one lands on the above questions may have knock-on impacts for how one thinks about other questions like Bitcoin’s long-term security budget, the role of Layer 2 solutions, the place for other blockchains and competition among blockchains, and BTC’s role as a Store-of-Value asset.

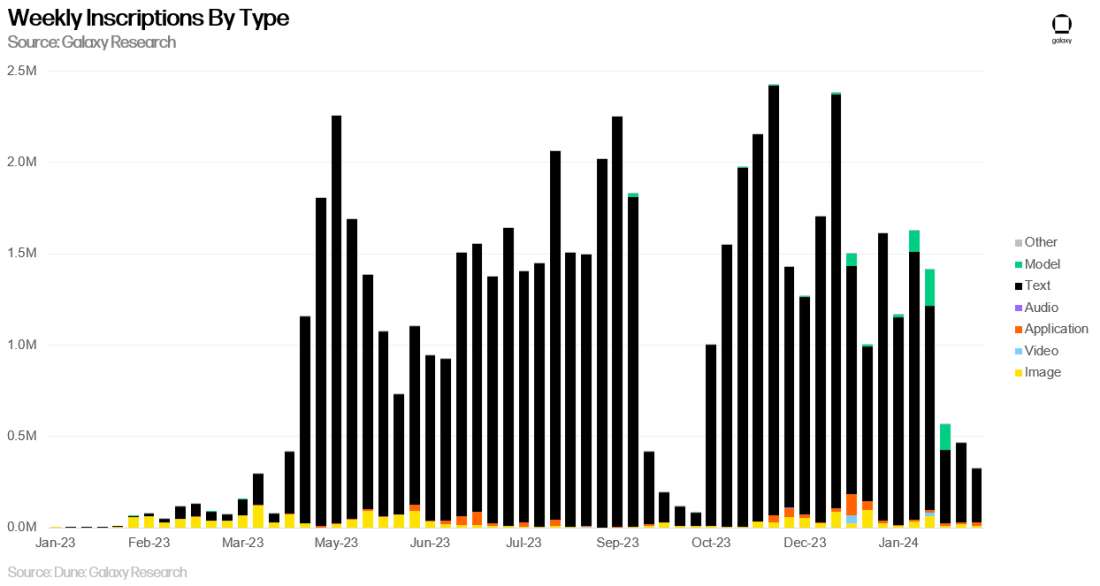

Ordinals Showed There is Demand for Bitcoin as a Platform

In any event, Ordinals have shown that there is real demand (on the order of millions of transactions per week) to do things other than hold and send BTC. Inscriptions are the process of recording arbitrary data into the Bitcoin blockchain and their success lends strength to Bitcoin’s position as a consensus platform. Ordinals showed the clear demand for Bitcoin blockspace that we believe will be replicated with rollups.

Rollups Will Pair Turing Completeness with Bitcoin Security

Bitcoin has historically been limited to an extremely constrained programming environment using Bitcoin Script, a very simplistic programming language which allows for multisig transactions, time locks, and other primitive functionality. However, because of limits in its programmability, Bitcoin as a network has been underutilized and its base asset — the most valuable cryptocurrency — has been stranded. Beyond that, the lack of interesting applications has meant fundamental risks to its long-term security due to sparse transaction fee income for miners. The adoption of miniscript, a higher-level programming language that enables much more expressive coding in Bitcoin Script, has meaningfully moved the needle here, but introducing Turing-complete L2s to Bitcoin will pour gas on the flame.

Once built, the EVM-compatible Citrea will enable programmability, ease-of-use, and security not previously available to Bitcoin users in expressive L2s, which will create further demand to use BTC as a financial collateral and broadly in on-chain applications. The team’s solution is technologically defensible and such inventive solutions will lead to greater adoption of Bitcoin as a settlement layer for rollups.

The Ambitious BitVM Work

Citrea’s latest achievement impressed us within Galaxy: the team is implementing a Zero Knowledge Proof verifier within open-source BitVM with implementation by the ZeroSync team that will allow the Citrea rollup to have trust-minimized bridging with Bitcoin. When we made the investment, Citrea was planning to launch a sovereign rollup that utilized Bitcoin for data availability and required a multisig bridge to pass assets and data down to Bitcoin. One Bitcoin developer jokingly asked, how to stop Bitcoin from being “a landfill for rollups” — referencing the limited actual tie between a sovereign rollup and a data availability platform. BitVM is the answer to that question and Citrea is well on their way to implementing it.

The Best is Yet to Come

Bitcoin is and always has been an open, decentralized platform to which anyone can interact without permission. The only constraint is that transactions must abide by network consensus rules. Citrea follows these rules while unlocking a powerful new computation layer for the world’s most valuable blockchain network.

Will Nuelle is general partner at Galaxy Ventures. Alex Thorn is Galaxy’s Head of Firmwide Research and a member of the firm’s investment committee.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.