Block Space: The Best New Business Model in Crypto

Introduction

New technologies enable new business models. Over the last three decades, many renowned investment firms built their respective practices around investing in software businesses. Software is first a technological revolution, but also a business model revolution enabled by the technology. Software-as-a-Service (“SaaS”) as a model is spawned by the easy replication of bits — a technological property — to create business model innovation: a product with zero marginal cost of replication, annually recurring revenues, and high switching costs. Investment firms, like Insight Partners, have claimed that SaaS is the best business model to ever exist, and they were successful because they understood that model better than anyone.

New technology platforms create powerful new business models and often entirely new markets. These are frequently great places to look for outsized investment returns. There are only four business models so far in crypto that can produce deep and enduring product-market fit — two existing (SaaS, and exchanges), one an adaption of a familiar model (stablecoins), and one new (block space). Stablecoins are fascinating and worthy of separate discussion, but only one of these listed below is net new — block space — and it happens to be the most interesting.

The business models in crypto today which can generate reproducible product-market fit are:

Software-as-a-Service: Software products like Fireblocks* and Chainalysis sell their software for subscriptions. Other companies like Alchemy sell their software service for a usage-based pricing model. Anchorage, Figment*, and Blockdaemon are principally software businesses that have an Asset Management-adjacent business model.

Exchange: Crypto’s propensity to financialize everything means that revenue from trading volume has been a stable and viable business model. This includes centralized (offchain) exchanges, decentralized (onchain) exchanges, NFT marketplaces, and more.

Stablecoins/Lending: Stablecoins are an instantiation of the familiar Net Interest Margin business model with the simple caveat that they create an exogenous incentive (onchain utility) to cede

deposits to the issuer without expecting yield on deposits. Tokenized assets should fall under this broader category over time.

Block Space (or “blockspace”): The sale of a specialty commodity compute resource on a per operation basis results in a business model of Price * Volume = Quantity. Block space has enduring demand-side network effects that create defensible moats around winners.

The critical goal of this piece is to evaluate block space as a commodity product, and the production of block space as an economic model. We cover price, metering, fee multiples, L1s, L2s, calldata and compression, EIP-4844 and more.

Even if you don’t believe that block space has a “business model”, the sale of block space (e.g., aggregate transaction fees) is the purest signal of demand for the product, and it should be used to differentiate between different block spaces.

Block Space is a Product That Consumers Buy

Block space as a product. To be clear, the producers of block space are not necessarily individual businesses or companies. They can be a decentralized network of individuals and companies enforcing the rules of a public blockchain like Bitcoin or Ethereum. Be it by a centralized company or decentralized blockchain, block space is a product being sold globally to consumers every 12 seconds.

Blockchains are a new type of computer that produce a unique form of compute – compute over which there’s global agreement. Blockchains are the infrastructural solution to the problem of value duplication on the Internet (internet deals more easily with text, jpgs, etc., not money) and block space is the commodity product being sold to consumers to mitigate this issue. And consumers do pay for it, anywhere from $3-10B per year in 2021, 2022, and 2023.

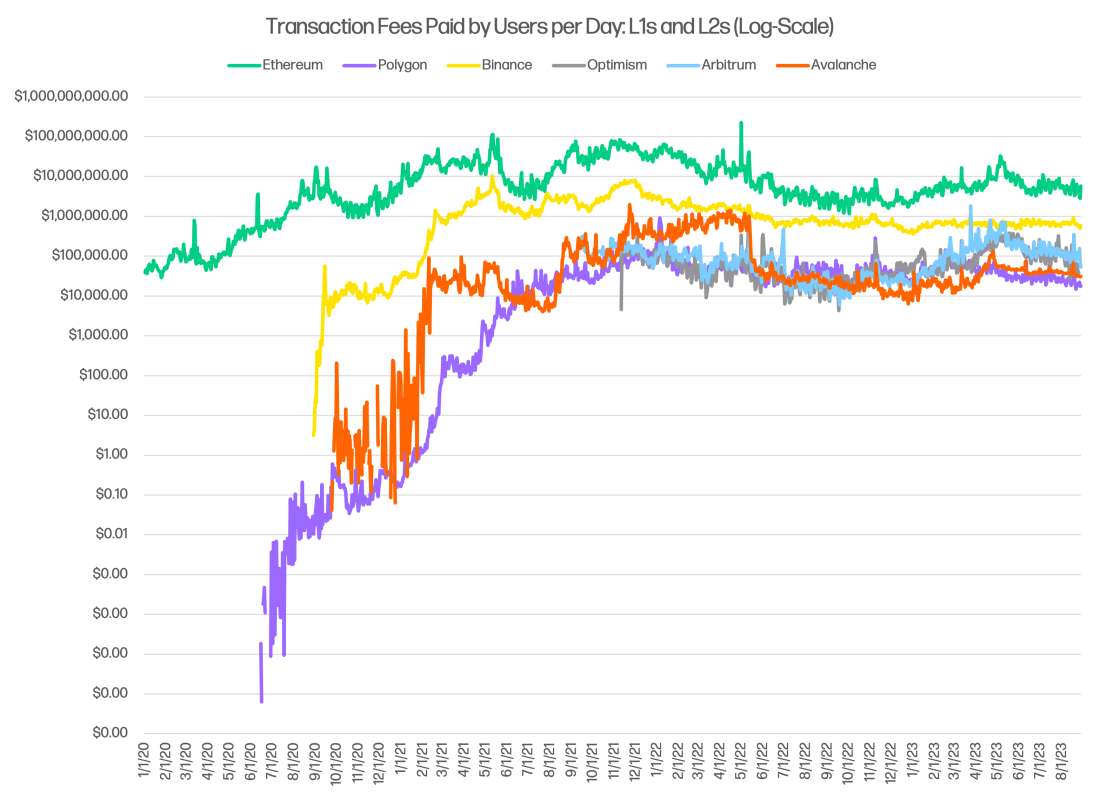

Price. Gas price is a signal of demand for block space (which itself is an amalgamation of compute, storage, and bandwidth resources). There are multiple sellers of block space in this market — all L1s, L2s, sidechains, etc. are producers and sellers of block space. Ethereum, Avalanche, Arbitrum, Optimism, Polygon*, and Binance Smart Chain are producers and sellers of block space.

As a rule, consumers are willing to pay more per transaction when there is a network effect around a seller’s block space; the consumer has a demand to use the block space that other applications and users are also using. Block space is a network effect-based business, where a network effect can coalesce around applications, developers, capital, and users, driving sustainably higher pricing per unit. Each dollar of capital deployed on Ethereum draws in more application developers, who then draw in more users by virtue of interesting applications and so on, a dynamic which also gave social media applications their virality. In short, there is more that users can do with block space on Ethereum than on Avalanche. As Chris Ahn from Haun Ventures writes, “Becoming more effective with scale is the ultimate form of defensibility.”

Network effect in part explains sustained differences in the sale price of block space between sellers:

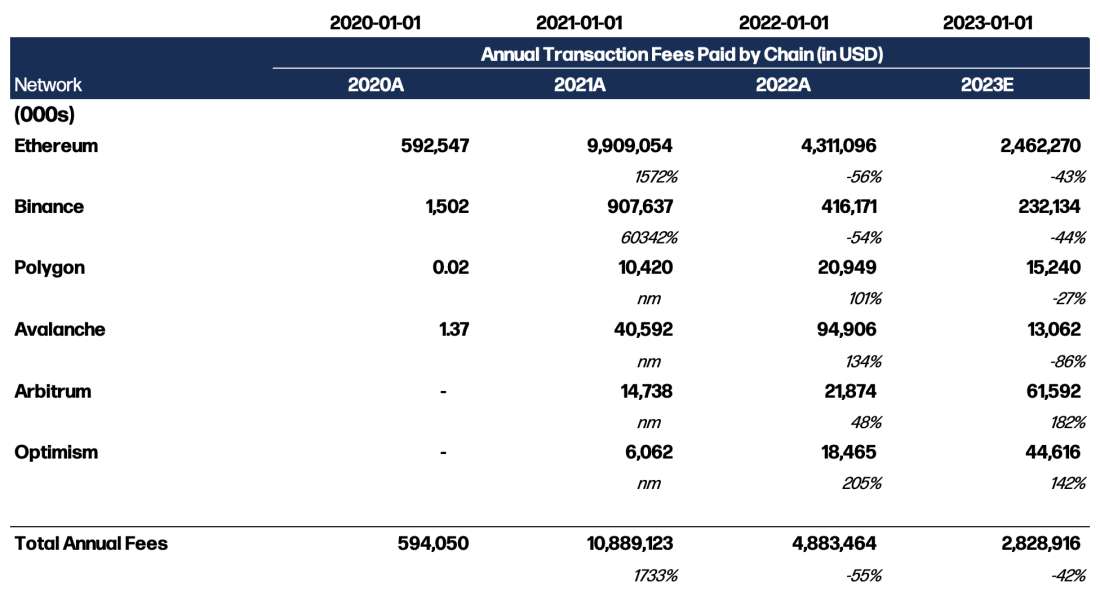

In aggregate, users are paying $1 - 10m per day to access Ethereum block space, while users collectively pay on the order of $10k – 100k per day to access alternate Arbitrum, and others. The amount consumers pay in Transaction Fees is a measure of aggregate demand for the block space. Daily fees paid follow exponential growth trajectories as a blockchain’s network effect expands (for example, with Polygon in late 2020). And while there’s a network effect, market share of block space is subject to constant internal rotation. For example, in the table below, Avalanche and Polygon grew fees by 100%+ Y/Y in 2022, while Arbitrum and Optimism have grown fees by 142%+ in 2023 Y/Y, showcasing a fickle market sensitive to changes in application, developers, and users. In Ethereum, pricing was originally done via a First Price Auction (consumers bidding for inclusion in the nearest block) and now with EIP-1559 via a PID controller (price dynamically adjusts up or down depending on most recent demand signal).

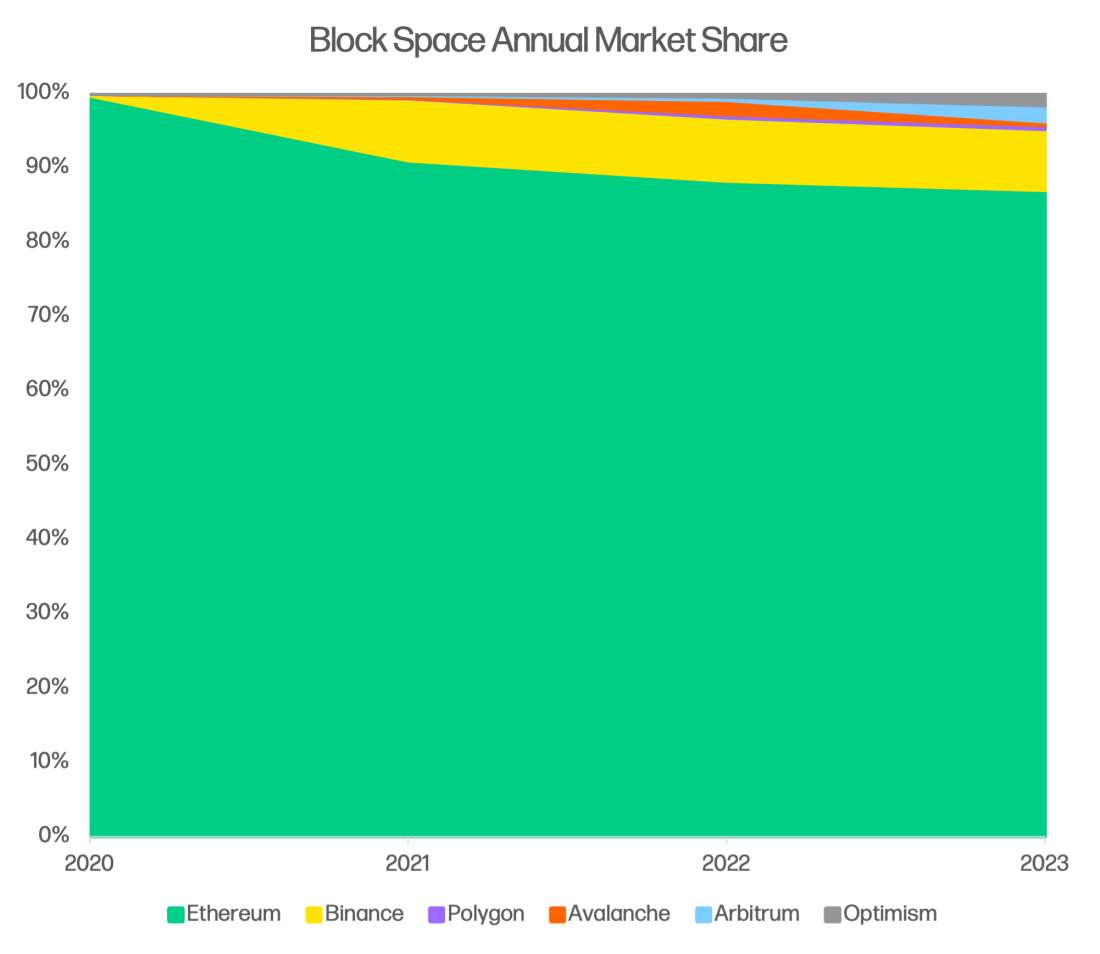

The Table above, ‘Block Space Annual Market Share’, shows transaction fees on an annual basis for the six largest fee-generating blockchains (ex. Solana). Aggregate fees paid have been in secular decline since 2021, largely driven by Ethereum, but since 2020, the entire block space market has seen a 47.7% CAGR. In the Table, major “rotation trades” are noticeable like the Alt-L1 rotation in 2022 (along with Polygon), and the market’s rotation into rollups in 2023.

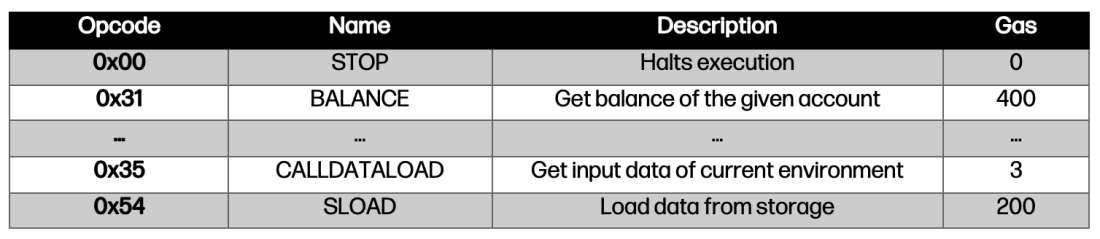

Metering. Consumers buy access to the resource on a per transaction basis — really, on a per operation (“op-code”) basis — at the moment of execution. They’re buying the right to compute and bandwidth resources for a fixed period of time, and storage over an indefinite period. In the EVM, each operation has a resource cost (gas) which is ascribed a price at the time of execution. The following chart has some notable EVM operations and their resource costs:

The only other thing to point out is that under this arrangement, we see the emergence of a new business model paradigm. Uniquely, consumers bear the cost to access block space, reverting decades old tradition of enterprises and startups buying rack space or paying AWS bills to serve the product to clients. Today, applications on blockchains can operate with zero overhead once deployed, since users pay for the cost of operation. Account abstraction may result in future arrangements where applications cover users’ gas costs reverting the block space costs back to startups and enterprises, mirroring the model we see today with rack space and AWS. This remains to be seen but would make sense in a future where applications jockey harder for users against competition.

The Market is Giving More Credit to Longer-Tail Block Space. Is it Warranted?

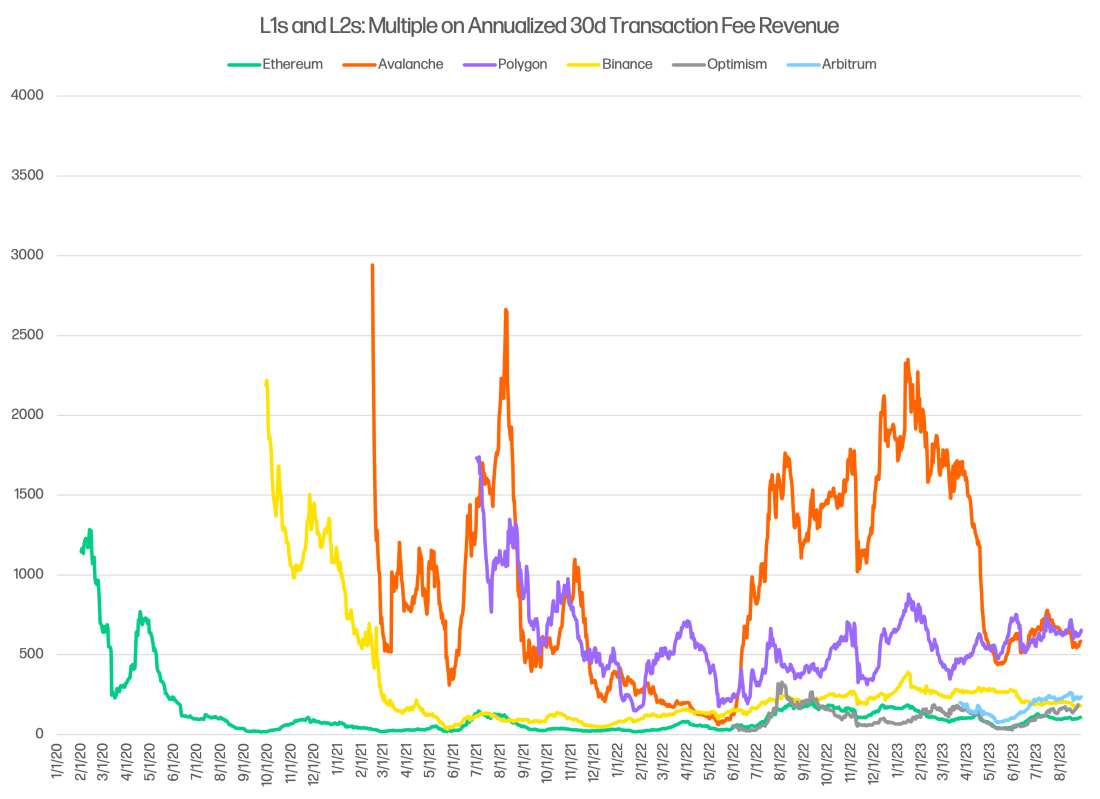

Fee Multiples. A ratio of Market Cap : Annual Transaction Fees shows the value that the market ascribes to a blockchain network per dollar of fees generated. (The analogy is a revenue multiple, though it’s an imperfect comparison.) Higher multiples mean the market is giving more credit in market cap per dollar paid. Higher multiples are typically given to assets that are perceived to have (i) stronger long-term growth prospects, (ii) better conversion of topline revenue into profit (i.e., higher margins), and (iii) more stability and projectability of future growth and margins, among other things.

Using this multiple chart, the market values Ethereum’s ‘Fees Paid’ the least of the six blockchains, at about 100x its annualized fees. On its face, this may seem counterintuitive: Ethereum is competing to be a “macro asset” which — like Bitcoin — should garner a Store-of-Value premium as a form of “money”, plus earn a monetary premium from its deep liquidity, its use in-protocol for staking, and as collateral onchain. Store-of-Value premium would be represented as a higher multiple versus Avalanche, Polygon, Arbitrum, and others. Ethereum also qualitatively has a stronger, more durable network effect, which should be supportive to a relative premium.

On the other hand, the market may also reflect that Ethereum is more capacity constrained at 15 tx/sec and is discounting growth of Ethereum fees over time. Growth in Fees Paid for Ethereum can only come from rising gas costs, unlike Optimism and Arbitrum which can earn more from added scale and increasing demand. Beyond that, Ethereum is on the wrong side of a 2-year rotation trade between blockchains, pulling market share from Ethereum. Rotation into new alternatives is bringing growth to other venues that can support higher scale. We will discuss this in regard to L2s as a business model.

Cost of Block Space Production

A more incisive question is not what a blockchain earns per unit of block space, but what it costs to produce each unit of block space. That’s where interesting differences arise.

L1s. Layer-1 blockchains like Ethereum and Avalanche use in-kind token incentivizes to produce the Sybil-resistance mechanism — Proof-of-Work and Proof-of-Stake — required for consensus. Consensus, as we discussed above, and data availability are what makes block space different from plain compute. The incentivization to produce this effect is a cost in the creation of block space for L1s.

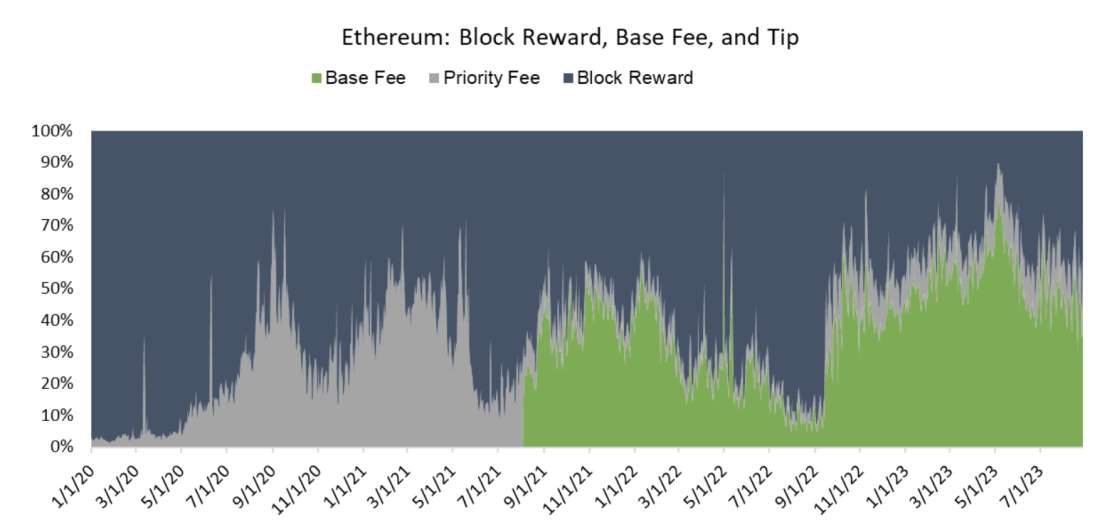

Each Ethereum block is comprised of a Base Fee, a Priority Fee, and a Block Reward. Base Fee and Priority Fee are components of a transaction fee under EIP-1559. Base Fee is burned by the protocol, reducing supply of ETH, while Priority Fee is paid to validators. Block Reward is new primary issuance.

To incentivize block production in Proof-of-Work, Ethereum paid out an average of ~12,600 ETH per day in block rewards, which at the peak of the market was as much of $60m per day in new primary issuance to incentivize the creation of block space. In Proof-of-Stake, it’s more complicated: incentives are determined by a complex function, under which Ethereum has paid ~1,850 ETH per day since The Merge (a number that’s rising proportional to number of validators). In either case, these incentives paid to miners/validators are a Cost of Goods Sold (COGS) for block space.

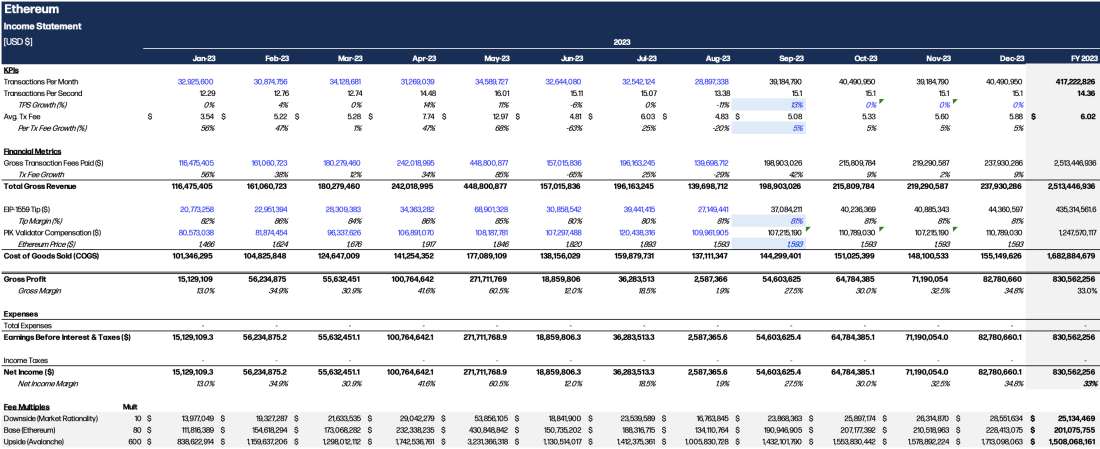

The sale of Ethereum’s block space can be described by an income statement. The income statement below has Transaction Fees and COGS dollarized in order to provide an apt analysis and also because consumers will largely still denominate their transactions in dollars. As a note, the Ethereum Foundation and associated researchers don’t care to optimize transaction fees paid, nor is it a stated goal of the community. The goal is clearly the opposite, to provide cheap and scalable block space.

There’s a fundamental paradox to block space as a business model: supply constraints boost transaction fees but inhibit the core objective of L1 systems, which is to low latency and cheap compute.

Ethereum Income Statement

There’s much to say about this Ethereum income statement, but I will reduce it to a few salient points:

Flat throughput requires fee growth. Ethereum won’t execute more than 16 transactions per second throughput for the foreseeable future, so its only way of growing revenue is with rising transaction fees. This may happen as increasing economic density from batching on the L2 pushes fees up.

Fees are highly cyclical. Block space isn’t a business with sticky income (yet). As a market, it is subject to the volatile whims of the consumer.

Net income margins equal gross margins. The unique feature of Ethereum and other blockchain networks is that they require zero OpEx. All costs are borne as direct costs for making the product. It’s as if Uber drivers also themselves powered the software application that coordinates their routes.

L2s. Rollups — the dominant form of layer-2 solution — do not require exogenous token incentives to produce block space and instead buys it from Ethereum on-demand. Rollups take execution of transactions offchain and then batch transaction data into calldata on Ethereum. Calldata is just a fancy storage location that goes along with an EVM transaction.

In taking transaction execution off-chain and batching the results, rollups can achieve much greater scale. They are functionally unbounded in throughput, except by demand and — within an order of magnitude — by the amount of data Ethereum or a system like Celestia* can provide to rollups.

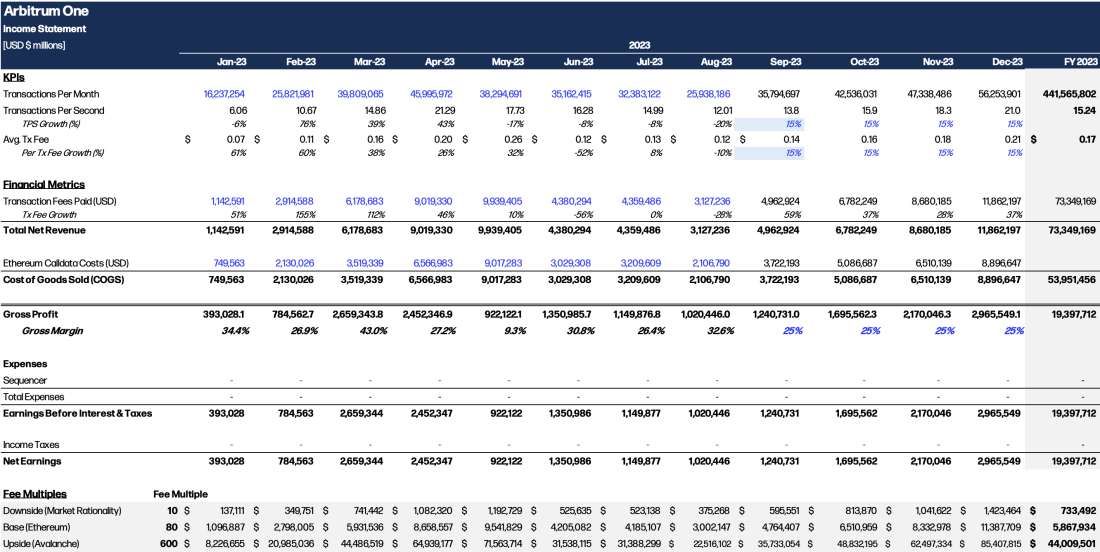

Arbitrum Income Statement

Arbitrum, like Ethereum, has poor gross margins, but transaction throughput showed 30%+ M/M growth through May of 2023, scaling up to 21.3 tx/sec. A few notes on Arbitrum’s income statement:

Uncapped upside scale: Rollups are unbounded on the upside with scale, at least within several multiples of their current transaction throughput. Throughput is a function of application demand.

Sequencers: Currently, Arbitrum’s centralized sequencer — run by Offchain Labs — doesn’t take any earnings, and passes the protocol’s profits off to the DAO (it contributed 3,350 ETH to the DAO in May). Sequencer dynamics will evolve and will have an impact on the profitability of selling L2 block space.

Future Margins: In the next section, we will address changes to the Ethereum protocol and Celestia which will reduce L2 COGS by cutting calldata costs and will reduce fees to Ethereum.

We can see that L1s and L2s have fundamentally different costs to produce block space. L1s have floating income (transaction fees) and fixed costs (block rewards), while L2s have floating income and floating costs. L1s have constrained scale (e.g. 15 tps) and inconsistent 10% – 60% margins, while L2s scale with user demand and have consistent 25% margins but rising to 75%+.

What They Give in Margins, They Get in Scale, but Soon They’ll Get Back in Scale: Layer-2 Blockchains and Calldata

How would public markets value a business with 3x Y/Y growth and a 25% net income margin? What if I threw in the possibility that the business can achieve structural improvements which send net income margins rising to 75%+?

This is exactly the position which Arbitrum, Optimism, and ZKSync find themselves in with new developments like data compression, EIP-4844, and Celestia, which will slash the cost of data for rollups.

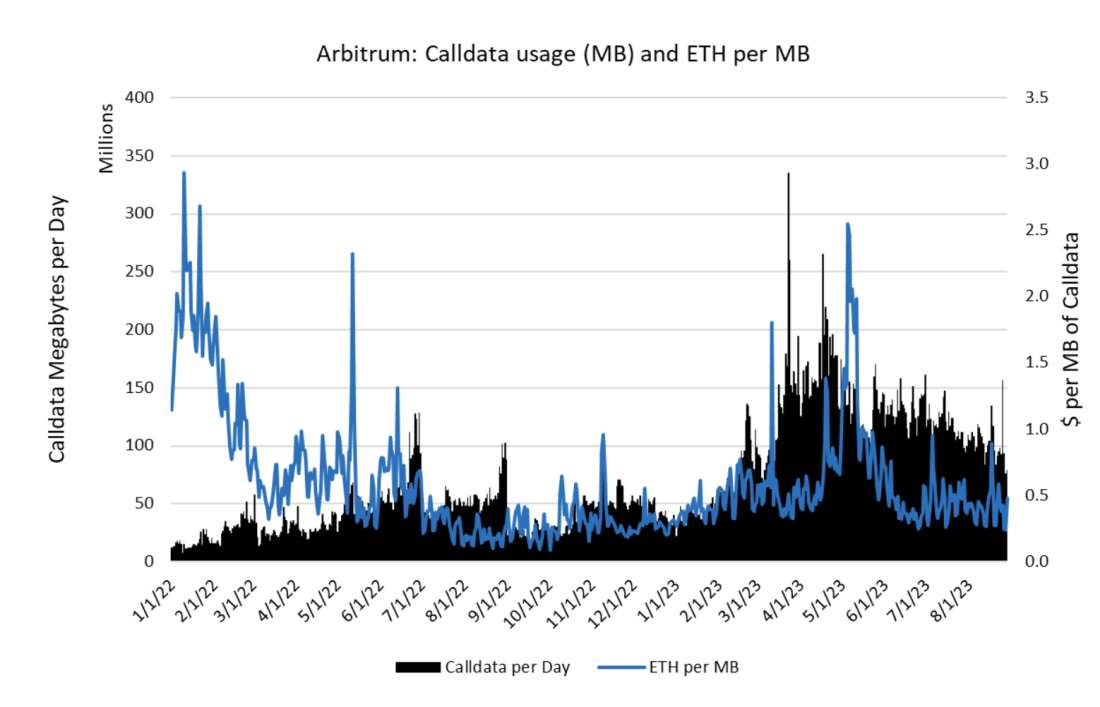

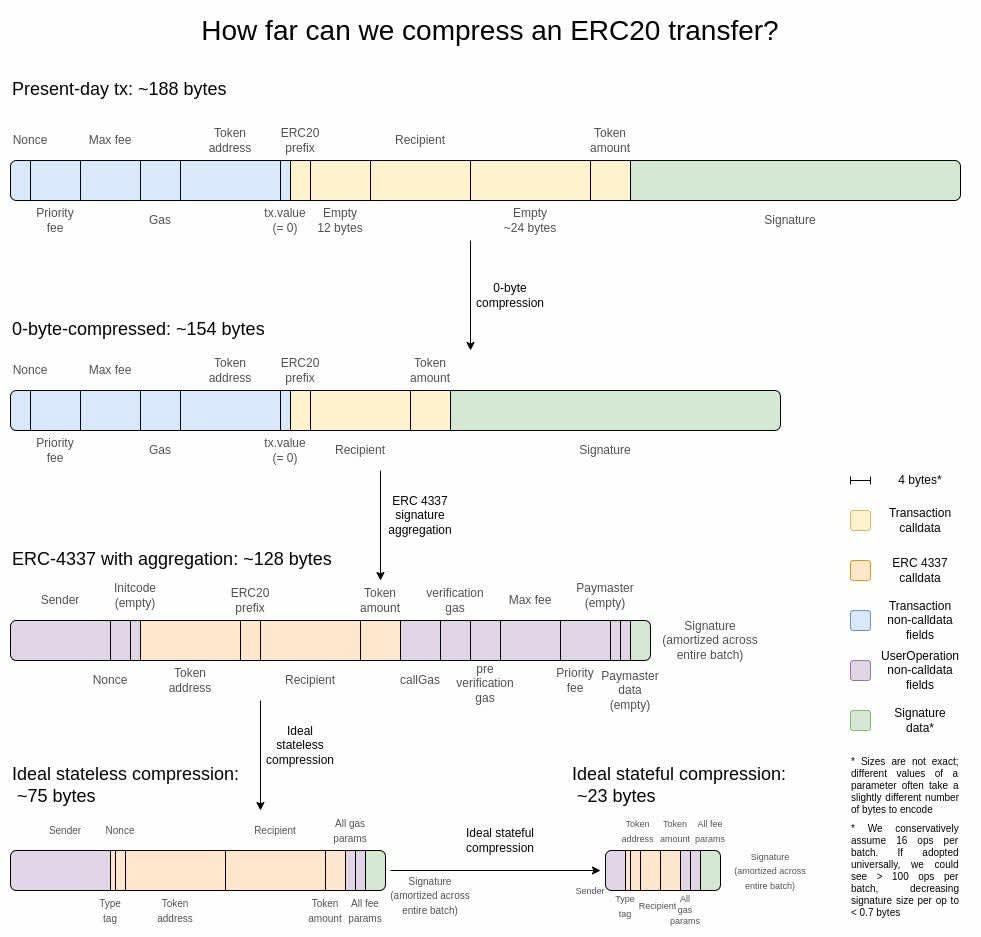

Calldata and compression. Calldata is a data storage location that is appended to transactions, and rollups use it for data availability from Ethereum, depositing state data down to L1.

Arbitrum deposited 3.0 GB of data to Ethereum L1 calldata in August ’23 and 5.4 GB at its highest point in May ’23, at prices per MB of $1,144 and $1,840 respectively. The amount of calldata used per day naturally correlates tightly with transactions per day, while the price of calldata fluctuates with market demand. Arbitrum’s May throughput corresponds to 2.2 kb/s and August’s throughput corresponds to 1.2 kb/s.

Worse compression means explicitly higher data costs for rollups — the Cost of Goods Sold line item in the income statement. Unit economically, rollups can either (i) pass on higher costs to consumers or (ii) accept lower gross margins in the face of higher COGS. There are abundant opportunities for further compression still available to rollups, with techniques like zero-byte compression, signature aggregation, and eventually stateless compression.

EIP-4844. Compression of rollup data can only go so far, so Ethereum and other blockchains like Celestia* have sought to make data availability cheaper. EIP-4844 is an Ethereum upgrade which will slash the cost of data availability for rollups. Original EIP-4488 designs had the cost of calldata falling to three gas per byte from sixteen gas per byte under the precursor EIP-4488.

Ethereum researchers opted for a more complex 4844, which has two principal adjustments:

Blob space: Rather than shoving rollup state into calldata, EIP-4844 opens up a new “blob space” for rollup data, which is a new 262 kB/block, or 21.8 kb/s. Ethereum currently offers ~175 kB/block, or 14.7 kB/s, so 1.5x more data availability capacity will be available to rollups in the near term. Over time, “blob space” will grow to 1 MB/block, a 5x increase.

Multi-dimensional fee markets: EIP-4844 will also introduce distinct pricing schemes for blobs versus gas (i.e. normal Ethereum execution), meaning rollups will operate with different gas prices that depend on rollup demand.

The exact impacts of EIP-4844 on L2 data costs are hard to project, but 1.5 – 5x more capacity with a siloed resource pricing model will reduce COGS for rollups up to 4x+ over time. A 4x drop in data costs would result in an 81% gross margin for Arbitrum. Rollups are such an exciting business model in this context.

Summary: Block Space as a Business Model

To summarize, consumers are purchasing $8M+ worth of block space every day. Blockchains coordinate the production of this commodity resource and the business model for doing so has distinct properties: (i) high cyclicality and high correlation with market volatility, (ii) poor gross margin profile, but attractive operating margins, (iii) network effect-based business, and (iv) software scale.

Is this a good business or a bad business? My instinct now is that the sale of block space is a very exciting business model, with some clear positives (network effect-based moats) and clear negatives (poor quality of revenue due to cyclicality). The other clear negative is that existing regulation doesn’t allow these networks to take surplus cashflows today, and generally struggles to incorporate them into existing asset frameworks. If the industry can continue to add stable application-layer use cases, blockchains with the strongest network effects like Ethereum, Binance, Arbitrum, and Optimism may eventually be capable of generating $10s or $100s of billions in topline 'Fees Paid’ per year and retain positive gross and net income margins. The way to capture this excess value will be to allocate income down to a DAO, like Arbitrum does today.

The alternate viewpoint on block space. There is a wholly different perspective on the economic model of L1s, L2s, and DA layers: that the objective is not transaction fee revenue, but to offer the cheapest block space and ergo the best application layer. The theory goes that users will eventually coalesce around the winning platform’s base asset (ETH, MATIC, AVAX) as a Store-of-Value. While blockchains might be vying for this, it doesn’t seem to be the right framework because (a) stablecoins exist and mainstream users will be more likely to store value in stablecoins than e.g. AVAX; (b) it seems self-evident that not every L1 token can be a SoV asset; and (c) L2s are clearly not playing this game. The SoV play is only a relevant consideration for a few assets (BTC, ETH, TIA*, maybe SOL/other L1 tokens) and it will rear its head as a premium to its intrinsic economic value.

Further points. As a parting point, there are a few avenues for further exploration (some of which we’ve embarked upon at Galaxy):

What is the relationship between MEV and the aggregate value of block space: One exercise would be to evaluate transaction fee distributions to understand how much revenue is attributable to MEV activity. As a quick-and-dirty analysis, there were $247M in annualized income in the Proposer-Builder Separation (PBS) system through April 30th.

Value accrual and competition amongst L2s: We keep a directory of rollups that are being developed publicly or privately. Right now, there are nearly 100 rollups, but we expect that number to scale from 100s – 1000s over time, due to the diminishing cost to launch one. With only 22 kb/s near time capacity with Ethereum DA, we’re thinking critically about how competition between L2s will ensue, likely requiring a long-tail of rollups to use Celestia* and EigenDA over time. We expect this to occur through COGS price competition.

*Denotes a portfolio company of Galaxy’s venture team.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.